INVESTMENT THESIS: PART 2

In this investment thesis, our focus extends to Decentralized Finance (DeFi), Real World Assets (RWA) and Decentralized Social Media Apps (DeSoc).

DeFi & RWA: Catalyzing a Money Market Renaissance

The trajectory of Decentralized Finance (DeFi) has been remarkable since the advent of MakerDAO’s DAI stablecoin in 2017, marking a significant milestone in the evolution of the crypto-financial landscape. This innovation laid the groundwork for a plethora of DeFi products, including Uniswap’s trading platform and dYdX’s margin trading capabilities.

The demand for DeFi services reached new heights during the ‘DeFi Summer’ of 2020, propelled by Compound’s introduction of yield farming. At Metazero, we recognize this period as a Renaissance in the money market ecosystem, driven by DeFi innovations. Our focus is on identifying and investing in platforms that continue to push the boundaries of what’s possible in DeFi, particularly those that eff ectively bridge the gap between traditional financial assets and decentralized protocols.

Recognizing the importance of user education and interface simplicity in the growth and adoption of DeFi, MetaZero is committed to scouting and collaborating with founding engineers and teams that bring innovative value propositions to the DeFi ecosystem. Our focus extends to those who are redefining or introducing new money market strategies, with an emphasis on enhancing user experience and education.

The integration of Real World Assets (RWA) on-chain is a particularly intriguing area within the DeFi space that MetaZero is actively exploring. The tokenization of real-world assets such as currencies, securities, commodities, and bonds offers a unique opportunity to streamline traditional financial processes like trading, clearing, settling, and safekeeping. This is achieved through on-chain verification, which significantly reduces counterparty risks and operational frictions that are typically encountered in conventional money market practices.

However, while the potential of RWA in DeFi is evident, its practical application still requires more robust proof-of-concept, along with extensive user testing. These steps are crucial to ensure its efficacy and resilience in various market conditions. Despite these challenges, Metazero remains fiercely optimistic about the future of RWA integration within the blockchain ecosystem.

We anticipate that RWA will not only optimize yield strategies for a diverse range of DeFi participants but also provide a safer hedge against market downturns. Additionally, RWA could introduce new yield strategies that appeal to larger capital players, including institutional investors seeking more conservative investment options with fi xed interest rates. These attributes make RWA a promising avenue for expanding and enhancing the DeFi landscape, and MetaZero is committed to identifying and supporting innovations that bring RWA and blockchain technology closer together.

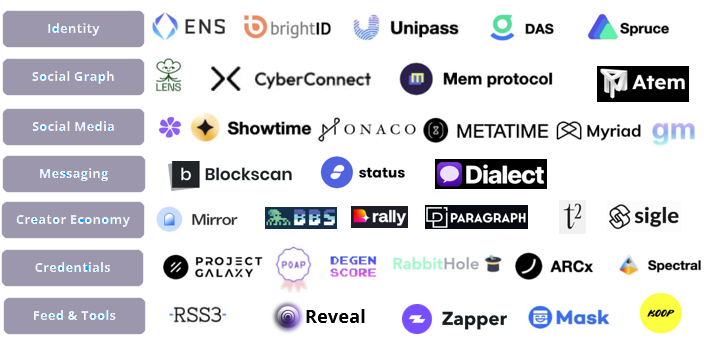

DeSoc: The Next Killer App

In the evolving landscape of web3 social media, Metazero has a keen focus on DeSoc (Decentralized Social Media Apps). Our vision of redefining social media through decentralization and fair value exchange revolves around how social media operates by prioritizing creator ownership and equitable content monetization.

At the core of our investment strategy lies the principle of content ownership. We believe that creators should have full control over their contents and IPs, ensuring that their creative rights are respected and protected in the digital realm as the varying NFT standards and token variances facilitate safeguards of intellectual property.

This approach not only empowers creators but also fosters a more diverse and inclusive social media ecosystem.

Equally critical to our approach is the concept of fair value creation. We are dedicated to backing founders ensuring equity and inclusion in the monetization of contents and creating a system where value is distributed more evenly, and creators are rewarded fairly for their contributions with less frictions in monetizing routes that are less accessible through fiats.

Recognizing the need for significant network effects to establish a foothold in this nascent category, our strategy includes the proactive identification and investment in potential ‘killer apps’. We draw inspiration from past successes, however, our expectations are set even higher due to the unprecedented growth in multi-chain integration and the continuous evolution of layer-2 scaling solutions, as well as layer-3 app chains.